Black Friday hit record highs as shopping carts in the Baltic states surged by more than a third

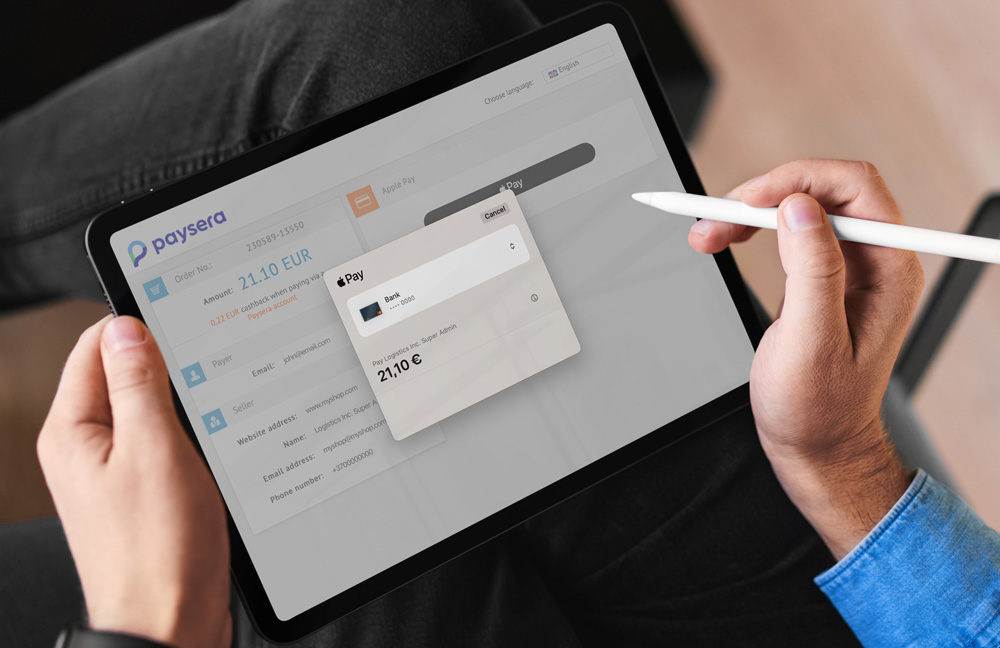

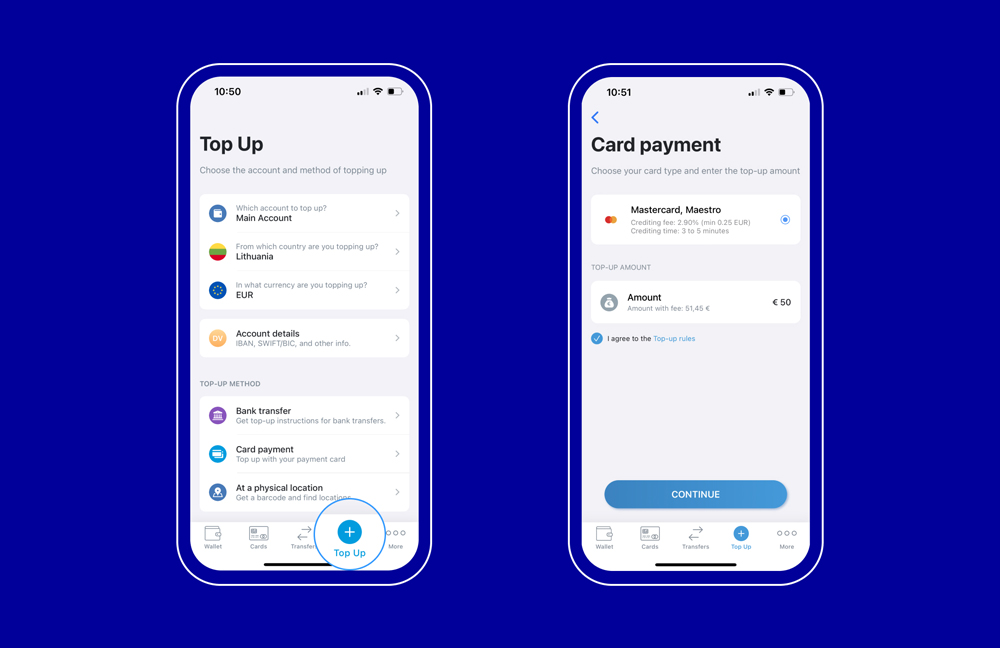

This year’s Black Friday generated record activity across the Baltic states, with online spending rising by 27 per cent compared with an average day in November. The average shopping basket also saw a significant boost, rising 36 per cent year-on-year, according to Paysera, the payment processor for more than 13,000 e-shops.